UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for the use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-1l (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: |

DOCUMENT SECURITY SYSTEMS,DSS, INC.

200 CANAL VIEW BOULEVARD, SUITE 1046 FRAMARK DRIVE,

ROCHESTER, NEW YORK 14623VICTOR, NY 14564

NOTICE OF 20202021 ANNUAL MEETING OF STOCKHOLDERS

To our Stockholders:

The 20202021 Annual Meeting of Stockholders of Document Security Systems,DSS, Inc. (the “Company”, “we”, “us” or “our”) will be held at 32731 Egypt Lane,1400 Broadfield Blvd., Suite 602, Magnolia, Texas 77354100, Houston, TX 77084 on Tuesday, December 8, 2020,November 9, 2021, at 10:30 a.m.9:00 am local time, for the purposes of:

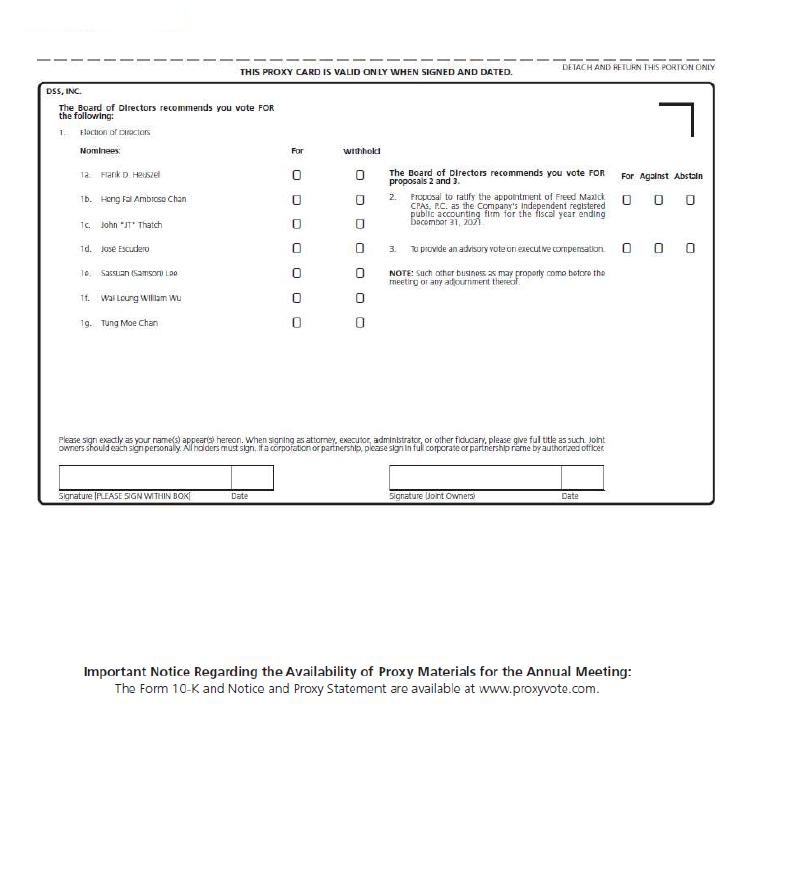

| 1. | To elect | |

| 2. | To ratify the appointment of Freed Maxick CPAs, P.C. as the Company’s independent registered public accounting firm for the fiscal year ending December 31, | |

| 3. | To provide an advisory vote on executive | |

We also will transact such other business as may properly come before the meeting and any adjournments or postponements of the meeting. The foregoing items of business are more fully described in the Proxy Statement accompanying this notice.

The Board of Directors has fixed the close of business on October 29, 2020September 14, 2021 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and at any adjournment or postponement thereof. These proxy materials will be mailed on or about November 3, 2020September 30, 2021 to the stockholders of record on the Record Daterecord date

The Board of Directors recommends that you vote “FOR” the proposals set forth in this Notice of Annual Meeting of Stockholders and the Proxy Statement.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING: The Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019,2020, and the Company’s Proxy Statement for the 20202021 Annual Meeting of Stockholders, along with any amendments to the foregoing materials that are required to be furnished to stockholders, will be available at www.proxyvote.com.

| By order of the Board of Directors | |

| /s/ Heng Fai Ambrose Chan | |

Heng Fai Ambrose Chan Chairman of the Board |

WHETHER OR NOT YOU PLAN ON ATTENDING THE ANNUAL MEETING IN PERSON, PLEASE VOTE AS PROMPTLY AS POSSIBLE TO ENSURE THAT YOUR VOTE IS COUNTED.

Table of Contents

DOCUMENT SECURITY SYSTEMS,DSS, INC.

200 CANAL VIEW BOULEVARD, SUITE 1046 FRAMARK DRIVE

ROCHESTER,VICTOR, NEW YORK 1462314564

PROXY STATEMENT FOR THE COMPANY’S

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 8, 2020NOVEMBER 9, 2021

We are furnishing this proxy statement (the “Proxy Statement”) to the holders of our common stock, par value $0.02 per share (the “Common Stock”), in connection with the solicitation of proxies on behalf of the Board of Directors (the “Board”) of Document Security Systems,DSS, Inc. (together with its consolidated subsidiaries (unless the context otherwise requires), referred to herein as “Document Security Systems,” “DSS,” “we,” “us,” “our” or the “Company”) for use at the 20202021 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at 32731 Egypt Lane,1400 Broadfield Blvd., Suite 602, Magnolia, Texas 77354,100, Houston, TX 77084, on Tuesday, December 8, 2020 10:30 a.m. local time,November 9, 2021, and any adjournment thereof. On September 30, 2021, the Company effected a merger pursuant to which the Company and its wholly-owned subsidiary, DSS, Inc., merged. Following the merger, the Company was the surviving corporation and the Company’s name was amended from Document Security Systems, Inc. to DSS, Inc.

The Annual Meeting will be held for the following purposes:

| 1. | To elect | |

| 2. | To ratify the appointment of Freed Maxick CPAs, P.C. as the Company’s independent registered public accounting firm for the year ending December 31, | |

| 3. | To provide an advisory vote to approve executive compensation; |

As of the date of this Proxy Statement, the Board is not aware of any other matters that will come before the Annual Meeting. However, if any other matters properly come before the Annual Meeting, the persons named as proxies will vote on them in accordance with their best judgment.

Important Notice Regarding the Availability of this Proxy Statement

We have opted to provide our materials pursuant to the full set delivery option in connection with the Annual Meeting. Under the full set delivery option, a Company delivers all proxy materials to its stockholders. The approximate date on which this Proxy Statement and form of proxy are first being provided to stockholders, or being made available through the Internet for those stockholders receiving their proxy materials electronically, is November 2, 2020.October 1, 2021. This delivery can be by mail or, if a stockholder has previously agreed, by e-mail. In addition to delivering proxy materials to stockholders, the Company must also post all proxy materials on a publicly accessible website and provide information to stockholders about how to access that website. Accordingly, you should have received our proxy materials by mail or, if you previously agreed, by e-mail. These proxy materials include the Notice of Annual Meeting of Stockholders, Proxy Statement, and proxy card. These materials are available free of charge at www.proxyvote.com

Any stockholder executing a proxy that is solicited has the power to revoke it prior to the voting of the proxy. Revocation may be made by i) attending the Annual Meeting and voting the shares of stock in person, ii) delivering to the Secretary of the Company at the principal office of the Company prior to the Annual Meeting a written notice of revocation or a later-dated, properly executed proxy, iii) signing another proxy card with a later date and returning it before the polls close at the Annual Meeting, or iv) voting again via the internet or by toll free telephone by following the instructions on the proxy card.

GENERAL INFORMATION ABOUT VOTING

Only the holders of record of our Common Stock at the close of business on the record date, October 29, 2020September 14, 2021 (the “Record Date”), are entitled to notice of and to vote at the meeting. On the Record Date, there were 5,836,21279,745,886 shares of our Common Stock outstanding. Stockholders are entitled to one vote for each share of Common Stock held on the Record Date.

Quorum

At all meetings of the Board, the presence at the commencement of a meeting of shareholders of the Company in person or by proxy of shareholders holding of record a majority of the total number of shares of the Company then issued and outstanding and entitled to vote shall be necessary and sufficient to constitute a quorum for the transaction of any business.

When a proxy is properly executed and returned (and not subsequently properly revoked), the shares it represents will be voted in accordance with the directions indicated thereon, or, if no direction is indicated thereon, it will be voted:

| (1) | FOR the election of each nominee as director; | |

| (2) | FOR the ratification of the appointment of Freed Maxick CPAs, P.C., as the Company’s independent registered public accounting firm; | |

| (3) | FOR the advisory resolution to approve executive compensation. |

Director nominees must receive a majority of the votes cast on such director’s election, which means that the nominee must receive more “FOR” votes than “WITHHOLD” votes.

The ratification of the appointment of our independent registered public accounting firm requires the affirmative vote of a majority of the votes cast at the meeting for this proposal. Abstentions and broker non-votes, if any, are not treated as votes cast, and therefore will have no effect on this proposal. A broker may vote on the ratification of the independent registered public accounting firm if a beneficial owner does not provide instructions; therefore, no broker non-votes are expected to exist in connection with this proposal.

The advisory vote on executive compensation will be decided by the affirmative vote of a majority of the votes cast on this proposal at the meeting. However, the stockholder vote on this matter will not be binding on our Company or the Board of Directors, and will not be construed as overruling or determining any decision by the Board on executive compensation.

The vote to approve the Proposal 4 and to approve the Proposal 5 each requires the affirmative vote of a majority of the votes of the outstanding shares of the Company’s stock entitled to vote on these proposals, For these items, an abstention has the practical effect of a vote against a proposal. For all other matters, abstentions do not count as votes cast, and therefore do not affect the vote outcome

Abstentions and Broker Non-Votes

Broker Non-Votes: If you hold your shares through a bank, broker or other nominee and do not provide voting instructions to that entity, it may vote your shares only on “routine” matters. For “non-routine” matters, the beneficial owner of such shares is required to provide instructions to the bank, broker or other nominee in order for them to be entitled to vote the shares held for the beneficial owner. The proposed ratification of the appointment of Freed Maxick CPA, P.C. as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 20202021 is considered a “routine” matter. Accordingly, brokers are entitled to vote uninstructed shares only with respect to the ratification of the appointment of Freed Maxick CPA,CPAs, P.C as our independent registered public accounting firm.

If you hold your shares in street name, it is critical that you cast your vote if you want it to count on all matters to be decided at the Annual Meeting.

Abstentions: Abstentions will be counted for purposes of determining whether a quorum is present for the Annual Meeting and will count as votes cast only in Proposal 4 (Ownership Limitation Increase) and Proposal 5 (Reincorporation); for these items, an abstention has the practical effect of a vote against a proposal. For all other matters, abstentions do not count as votes cast, and therefore do not affect the vote outcome.

***

You can contact our corporate headquarters, at (585) 325-3610,500-4669, or send a letter to: Investor Relations, Document Security Systems,DSS, Inc., 200 Canal View Boulevard, Suite 104, Rochester,6 Framark Dr., New York, 14623,Victor, New York 14564, with any questions about proposals described in this Proxy Statement or how to execute your vote.

Mr. Frank D. Heuszel, the Company’s principal accountant for the fiscal year ended December 31, 2019, and his representative plan to participate the Annual Meeting either in person or virtually via a video conference application. At the Annual Meeting, Mr. Frank D. Heuszel plans to make a brief statement and will make himself available to respond to appropriate questions about all of the proposals provided in this Proxy Statement.

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

EightSeven directors are to be elected at the Annual Meeting to serve until the next annual meeting of the Company’s stockholders. Unless otherwise instructed, the persons named in the accompanying proxy intend to vote the shares represented by the proxy for the election of the nominees listed below. Although it is not contemplated that any nominee will decline or be unable to serve as a director, in such event, proxies will be voted by the proxy holder for such other persons as may be designated by the Board of Directors, unless the Board of Directors reduces the number of directors to be elected.

| 3 |

The following table sets forth the nominees for directors on the Board of Directors. Certain biographical information about the nominees as of the Record Date can be found above in the section titled “Directors, Executive Officers and Corporate Governance.”

| Name | Age | Position(s) with the Company | Date First Elected or Appointed | |||||

| Frank D. Heuszel | Chief Executive Officer and Director | July 2018 | ||||||

| Heng Fai Ambrose Chan | Director, Executive Chairman | February 2017 | ||||||

| John “JT” Thatch | Lead Independent Director | May 2019 | ||||||

| José Escudero | Director | August 2019 | ||||||

| Sassuan (Samson) Lee | 50 | Director | August 2019 | |||||

Wai Leung William Wu | Director | October 2019 | ||||||

| Tung Moe Chan | Director | September 2020 | ||||||

Required Stockholder Vote and Recommendation of Our Board of Directors

Director nominees must receive a majority of the votes cast on such director’s election, which means that the nominee must receive more “FOR” votes than “WITHHOLD” votes.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL THE NOMINEES NAMED ABOVE.

PROPOSAL NO. 2 — RATIFICATION OF THE APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Company’s stockholders are being asked to ratify the Board of Directors’ appointment of Freed Maxick CPAs, P.C. as the Company’s independent registered public accounting firm for fiscal 2020.year 2021.

In the event that the ratification of this selection is not approved by an affirmative majority of the votes cast on the proposal at the Annual Meeting, the Board of Directors will review its future selection of the Company’s independent registered public accounting firm.

Representatives of Freed Maxick CPAs, P.C. are not expected to attend the Annual Meeting.

Audit fees consist of fees for professional services rendered for the audit of the Company’s consolidated financial statements included in the Company’s Annual Report on Form 10-K, the review of financial statements included in the Company’s Quarterly Reports on Form 10-Q, and for services that are normally provided by the auditor in connection with statutory and regulatory filings or engagements. The aggregate fees billed for professional services rendered by our principal accountant, Freed Maxick CPAs, P.C., for audit and review services for the fiscal years ended December 31, 20192020 and 20182019 were approximately $154,600$370,000 and $125,117,$154,600, respectively.

The aggregate fees billed for audit related services by our principal accountant, Freed Maxick CPAs, P.C., pertaining to comfort letterletters related to our registered offeringofferings during the years, consents for related registration statements and the audit of the Company’s employee benefit plan and review of the stand-alone financial statements for one of the Company’s subsidiaries, for the years ended December 31, 20192020 and 20182019 were approximately $51,450$98,000 and $26,800,$51,450, respectively.

| 4 |

The aggregate fees billed for professional services rendered by our principal accountant, Freed Maxick CPAs, P.C., for tax compliance, tax advice and tax planning during the years ended December 31, 20192020 and 20182019 were approximately $29,500$30,000 and $33,305,$29,500, respectively.

There were no fees billed for professional services rendered by our principal accountant, Freed Maxick CPAs, P.C., for other related services during the years ended December 31, 20192020 and 2018.2019.

Administration of the Engagement; Pre-Approval of Audit and Permissible Non-Audit Services

The Company’s Audit Committee Charter requires that the Audit Committee establish policies and procedures for pre-approval of all audit or permissible non-audit services provided by the Company’s independent auditors. Our Audit Committee, approved, in advance, all work performed by our principal accountant, Freed Maxick CPAs, P.C. These services may include audit services, audit-related services, tax services and other services. The Audit Committee may establish, either on an ongoing or case-by-case basis, pre-approval policies and procedures providing for delegated authority to approve the engagement of the independent registered public accounting firm, provided that the policies and procedures are detailed as to the particular services to be provided, the Audit Committee is informed about each service, and the policies and procedures do not result in the delegation of the Audit Committee’s authority to management. In accordance with these procedures, the Audit Committee pre-approved all services performed by Freed Maxick CPAs, P.C.

Required Stockholder Vote and Recommendation of Our Board of Directors

ApprovalRatification of the appointment of our independent registered public accounting firm requires the affirmative vote of a majority of the votes cast at the Annual Meeting, whether in person or by proxy, provided that a quorum is present. An abstention will not be counted for or against the proposal, and therefore will not affect the vote outcome.

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE

“FOR” THE RATIFICATION OF THE APPOINTMENT OF FREED MAXICK CPAs, P.C. AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2020.2021.

PROPOSAL NO. 3 - ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) requires the Company’s stockholders to have the opportunity to cast a non-binding advisory vote regarding the approval of the compensation disclosed in this Proxy Statement of the Company’s Named Executive Officers included in the summary compensation table and related disclosures. As discussed in the “Executive Compensation” section below, the Company has disclosed the compensation of the Named Executive Officers pursuant to rules adopted by the SEC.

We believe that our compensation policies for the Named Executive Officers are designed to attract, motivate and retain talented executive officers and are aligned with the long-term interests of the Company’s stockholders. This advisory stockholder vote, commonly referred to as a “say-on-pay vote,” gives you as a stockholder the opportunity to approve or not approve the compensation of the Named Executive Officers that is disclosed in this Proxy Statement by voting for or against the following resolution (or by abstaining with respect to the resolution):

RESOLVED, that the stockholders of Document Security Systems,DSS, Inc. approve all of the compensation of the Company’s executive officers who are named in the Summary Compensation Table of the Company’s 20202021 Proxy Statement, as such compensation is disclosed in the Company’s 20202021 Proxy Statement pursuant to Item 402 of Regulation S-K, which disclosure includes the Proxy Statement’s Summary Compensation Table and other executive compensation tables and related narrative disclosures.

| 5 |

Because your vote is advisory, it will not be binding on either the Board of Directors or the Company. However, the Company’s Compensation and Management Resources Committee will take into account the outcome of the stockholder vote on this proposal at the Annual Meeting when considering future executive compensation arrangements. In addition, your non-binding advisory votes described in this Proposal 3 will not be construed: (1) as overruling any decision by the Board of Directors, any Board committee or the Company relating to the compensation of the Named Executive Officers, or (2) as creating or changing any fiduciary duties or other duties on the part of the Board of Directors, any Board committee or the Company.

OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” APPROVAL OF THE COMPENSATION OF THE COMPANY’S EXECUTIVE OFFICERS DISCLOSED IN THE SUMMARY COMPENSATION TABLE OF THIS PROXY STATEMENT.

PROPOSAL NO. 4 — TO APPROVE, PURSUANT TO RULE 713 OF THE NYSE AMERICAN, THE POTENTIAL ISSUANCE OF COMMON STOCK UPON CONVERSION OF SERIES A CONVERTIBLE PREFERRED BY INCREASING THE BENEFICIAL OWNERSHIP LIMITATION

We are asking our stockholders to approve, pursuant to Rule 713 of the NYSE American, the potential issuance of shares of the Corporation’s Common Stock representing equal to or greater than 20% or more of presently outstanding stock, issuable upon conversion of our Series A Convertible Preferred Stock (“Series A Preferred Stock”) issued by the Company to Global BioMedical (as defined below) on August 21, 2020 in accordance with the Share Exchange Agreement dated April 27, 2020 (the “Share Exchange Agreement”), by increasing the 19.9% beneficial ownership conversion limitation (the “Ownership Limitation”) to 50.99% (the “Ownership Limitation Increase”). In particular, we are asking our stockholders to approve an amendment to our certificate of incorporation to effect the Ownership Limitation Increase.

The Ownership Limitation currently prohibits Global BioMedical from converting all or any portion of any share of Series A Preferred Stock to the extent that after giving effect to such issuance, Global BioMedical would beneficially own in excess of 19.99% of the Common Stock of the number of shares of the Common Stock outstanding immediately after giving effect to such issuance. Following the approval of the stockholders of the Company of the Ownership Limitation Increase, which approval is being sought pursuant to this Proposal 4, Global BioMedical will not be able to convert all or any portion of any share of Series A Preferred Stock to the extent any such conversion would cause Global BioMedical to beneficially own more than 50.99% of the outstanding Common Stock. Key terms of the Share Exchange Agreement and the Certificate of Amendment to the Certificate of Incorporation filed by the Company on August 18, 2020 with the Secretary of State of New York to establish the Series A Preferred Stock (the “Series A COD”) are summarized below. A copy of the Share Exchange Agreement and the Series A COD has been filed as Exhibit 10.1 to our Current Report on Form 8-K filed with the SEC on May 1, 2020 and as Exhibit 3.1 to our Current Report on Form 8-K filed with the SEC on August 27, 2020, respectively, and you are encouraged to review the full text of such Current Report, including the exhibits. The below summary of the Share Exchange Agreement and the transaction contemplated thereby do not purport to be complete and is subject to, and is qualified in its entirety by, the full text of such agreement.

Share Exchange Agreement

On April 27, 2020, the Company, DSS BioHealth Security, Inc., a Nevada corporation and wholly owned subsidiary of the Company (“DBHS”), Alset International Limited, Inc. (formerly known as Singapore eDevelopment Limited), a Singapore corporation (“Alset International”) that is listed on the Singapore Exchange, and Global BioMedical Pte Ltd, a Singapore corporation and wholly owned subsidiary of Alset International (“Global BioMedical”), entered into the Share Exchange Agreement, pursuant to which DBHS was to acquire of all of the outstanding capital stock (the “Impact Shares”) of Impact BioMedical Inc., a Nevada corporation and wholly owned subsidiary of Global BioMedical (“Impact BioMedical”).

On August 21, 2020, the Company completed its acquisition of Impact BioMedical, pursuant to the Share Exchange Agreement, which was approved by the Company’s stockholders on August 10, 2020 at a special meeting of stockholders (the “Share Exchange”). Under the terms of the Share Exchange, the Company issued 483,334 shares of Common Stock, nominally valued at $6.48 per share, and 46,868 shares of Series A Preferred Stock, with a stated value of $46,868,000, or $1,000 per share, for a total consideration valued at $50 million. As a result of the Share Exchange, Impact BioMedical is now a wholly-owned subsidiary of DSS BioHealth, the Company’s wholly-owned subsidiary.

As previously disclosed, Heng Fai Ambrose Chan is the Chief Executive Officer and largest stockholder of Alset International, as well as the Chairman of the Board and largest stockholder of the Company.

Series A Convertible Preferred Stock Certificate of Designation

As described above, in accordance with the terms of the Share Exchange Agreement, the Company issued 46,868 shares of Series A Preferred Stock, with a stated value of $46,868,000, or $1,000 per share, to Global BioMedical as partial consideration in exchange for the Impact Shares.

The rights and preferences of the Series A Preferred Stock were designated by the Company’s Board in the Series A COD, pursuant to which the Company authorized 46,868 shares of Series A Preferred Stock. Holders of the Series A Preferred Stock have no voting rights, except as required by applicable law or regulation, and no dividends accrue or are payable on the Series A Preferred Stock. The holders of Series A Preferred Stock are entitled to a liquidation preference at a liquidation value of $1,000 per share, and the Company has the right to redeem all or any portion of the then outstanding shares of Series A Preferred Stock, pro rata among all holders, at a redemption price per share equal to such liquidation value per share.

The Series A Preferred Stock ranks senior to Common Stock and any other class of securities that is specifically designated as junior to the Series A Preferred Stock with respect to rights on the distribution of assets on any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Company, in respect of a liquidation preference equal to its par value of $1,000. In addition, under the Series A COD, the Company has the right to convert all or any portion of the then outstanding shares of Series A Preferred Stock, pro rata among all holders, into an aggregate number of shares of Common Stock as is determined by (i) multiplying the number of shares to be converted by the liquidation value per share, and then (ii) dividing the result by the applicable conversion price then in effect.

As a holder of Series A Preferred Stock, Global BioMedical has no right to convert all or any portion of any share of Series A Preferred Stock as and to the extent giving effect to such issuance after conversion that Global BioMedical would beneficially own in excess of the Ownership Limitation. Following the approval of the stockholders of the Company of the Ownership Limitation Increase, which approval is being sought pursuant to this Proposal 4, Global BioMedical will not be able to convert all or any portion of any share of Series A Preferred Stock to the extent any such conversion would cause Global BioMedical to beneficially own more than 50.99% of the outstanding Common Stock.

Stockholder Approval Requirement

As noted above, the Share Exchange Agreement contemplates that the number of shares to be issued to Global BioMedical is limited to the 19.99% Ownership Limitation.

Rule 713 of the NYSE American requires stockholder approval of a transaction, other than a public offering, involving the sale, issuance or potential issuance by an issuer of Common Stock (or securities convertible into or exercisable for Common Stock) at a price less than the greater of book or market value which together with sales by officers, directors or principal stockholders of the issuer equals 20% or more of presently outstanding Common Stock, or equal to 20% or more of presently outstanding stock for less than the greater of book or market value of the stock, or when the issuance or potential issuance of additional shares will result in a change of control of the issuer. Stockholder approval of this Proposal 1 will constitute stockholder approval for purposes of Rule 713 of the NYSE American.

We are seeking stockholder approval of the Ownership Limitation Increase, which will permit the issuance to Global BioMedical upon conversion of the Series A Preferred Stock of up to 50.99% of our outstanding Common Stock.

If our stockholders do not approve this Proposal, the Ownership Limitation will remain at 19.99%.

The Board believes that the Ownership Limitation Increase is in the best interests of the Company and its stockholders to help simplify the Company’s balance sheet in order to help investors and others to better understand, compare and analyze the Company’s operating performance from period to period. In addition, by increasing the Ownership Limitation, the Board believes that allowing Global BioMedical to periodically exercise its Series A Preferred Stock to common stock conversion rights it would demonstrate to other shareholders and potential investors its continued support and commitment to the long-term business goals of the Company. Further, Management believes that by increasing the Ownership Limitation, will also help in future merger and acquisition opportunities and provide greater flexibility in negotiating potential acquisition structures, whether in cash, Company stock, debt, or a combination thereof.

Effect on Current Stockholders; Dilution

If Proposal 4 is approved, our existing stockholders will suffer additional dilution in voting rights upon the issuance of Common Stock upon conversion of shares of Series A Preferred Stock above the Ownership Limitation. As described above, if Proposal 4 is approved, Global BioMedical will not be able to convert all or any portion of any share of Series A Preferred Stock to the extent any such conversion would cause Global BioMedical to beneficially own more than 50.99% of the outstanding Common Stock.

Specifically, if Proposal 4 is approved, based on the conversion of all Series A Preferred Stock held by Global BioMedical, subject to the Ownership Limitation Increase, up to 3,743,034 shares of the Common Stock would be issuable. Based on the number of shares of Common Stock outstanding as of the Record Date, such shares would represent 50.99% of our total outstanding shares (giving effect to such issuance). The sale into the public market of these newly-issued shares of Common Stock could adversely affect the market price of our Common Stock. The issuance of such shares may result in significant dilution to our stockholders and afford them a smaller percentage interest in the voting power, liquidation value and aggregate book value of the Company. This means that our current stockholders will own a smaller interest in our Company and will have less ability to influence significant corporate decisions requiring stockholder approval.

As noted above, the Share Exchange Agreement contemplates that the Company shall not issue, and Global BioMedical shall not acquire, any shares of our Common Stock upon conversion of Series A Preferred Stock if such shares proposed to be issued and sold, when aggregated with all other shares of our Common Stock then owned beneficially by Global BioMedical and its affiliates, would result in the beneficial ownership by Global BioMedical and its affiliates in excess of the Ownership Limitation. If approved, the Ownership Limitation Increase would limit the number of shares Global BioMedical may beneficially own at any one time to 50.99% of our outstanding Common Stock. Consequently, the number of shares Global BioMedical may beneficially own in compliance with the Ownership Limitation Increase may increase over time as the number of outstanding shares of our Common Stock increases over time. Global BioMedical may be in a position to exert influence over the Company and there is no guarantee that the interests of Global BioMedical will align with the interests of other stockholders.

The rights and privileges associated with all shares of Common Stock issuable upon conversion of Series A Preferred Stock, however, are identical to the rights and privileges associated with the Common Stock held by our existing stockholders, and will not include preemptive, conversion or other rights to subscribe for additional shares of Common Stock.

The approval of the amendment to our certificate of incorporation to effect the Ownership Limitation Increase requires the affirmative vote of a majority of the outstanding shares of the Company’s stock entitled to vote on this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL 4.

PROPOSAL 5 - REINCORPORATION OF THE COMPANY FROM NEW YORK TO TEXAS

Our Board has unanimously approved and recommends to our stockholders this proposal to change the Company’s state of incorporation from New York to Texas (the “Reincorporation”), subject to stockholder approval. The Reincorporation would be effected pursuant to a merger (the “Merger”) with Alset, Inc., a wholly-owned subsidiary of the Company incorporated in Texas (“Alset”). The Company will enter into an Agreement and Plan of Merger (the “Merger Agreement”) in the form attached to this Proxy Statement under Exhibit I, whereby the Company will merge with and into Alset. In addition, following the Reincorporation, the Company will no longer be a New York corporation governed by the Company’s current Certificate of Incorporation (the “New York Charter”) and its current By-laws (the “New York By-laws” and, together with the New York Charter, the “New York Governing Documents”) and will instead’ be a Texas corporation governed by the proposed Texas Amended and Restated Certificate of Formation (the “Texas Charter”) and the proposed Texas By-laws (the “Texas By-laws” and, together with the Texas Charter, the “Texas Governing Documents”), each in the form attached to this Proxy Statement under Exhibits II and III, respectively. Our Board has determined that the terms of the Merger Agreement, the Merger, the Texas Charter and the Texas By-laws are fair to, and in the best interests of, the Company and our stockholders.

For the reasons discussed below, the Board recommends that the stockholders vote “FOR” the Reincorporation Proposal. Approval of the Reincorporation Proposal will constitute adoption of the Merger Agreement and approval of the Texas Charter and Texas By-laws. All descriptions of the Texas Governing Documents are qualified by and subject to the more complete information set forth in those documents.

Implementing the Reincorporation, will have, among other things, the following effects:

|

The Reincorporation will become effective upon filing of certificates of merger with the Secretary of State of each of New York and Texas, which filings are expected to be made as soon as practicable after stockholder adoption of the Merger Agreement. Pursuant to the terms of the Merger Agreement, the Reincorporation may be abandoned by the Board at any time before the Effective Time (whether before or after approval by the Company’s stockholders). In addition, the Company and Alset may amend the Merger Agreement at any time before the Effective Time (whether before or after approval by the Company’s stockholders), provided that after approval by the Company’s stockholders, no amendment may be made that by law requires further approval by the Company’s stockholders without obtaining such further approval.

No regulatory approval (other than various filings with Secretary of State of Texas and Texas discussed above) is required to effect the Reincorporation. The terms of the Reincorporation and Merger are described in more detail in the Merger Agreement and all descriptions of the Reincorporation are qualified by and subject to the more complete information therein.

Reasons for the Reincorporation

In connection with the Reincorporation, our Board has determined that it is advisable and in the Company’s best interest to change the Company’s name from “Document Security Systems, Inc.” to “Alset, Inc.” to better align it with the Company’s principal business operations (the “Name Change”). The Board believes the proposed new name recognizes the expanded scope of our business and operation, however, the name of “Alset” is currently not available in the State of New York. The management of the Company discovered that the intended new name is available in the State of Texas and therefore suggested to the Board to re-incorporate in the Company in the State of Texas to be able to use the name of “Alset.”

The Company believes that the Texas legislature has demonstrated a willingness to maintain modern and effective corporation laws to meet changing business needs. While some regard NYBCL as an extensive and well-defined body of corporate law in the United States, the Company does not believe there is a significant risk to the Company or its stockholders if the Company is governed under TBOC rather than NYBCL. While there are some advantages under NYBCL to being a New York corporation, there are also advantages under TBOC law to being a Texas corporation.

The Company believes that, on balance, the impact on the Company of implementing the Reincorporation Proposal from a corporate law perspective will be positive to the Company and its stockholders. We have provided a discussion of differences between the NYBCL and TBOC below under the heading “Comparison of Stockholder Rights Before and After the Reincorporation.”

The Board believes that the Name Change is in the best interest of the Company to create a name which is not related to the former business attempt, in which the Company may never again engage. The Board also believes that the Name Change will better reflects the nature of our anticipated operations. The Name Change is contingent and conditioned on stockholder approval of this Proposal, and, if the stockholders approve this Proposal 5, the Name Change will be effected through the filing of the Texas Charter.

Capitalization

Our authorized capital on the date of this Proxy Statement consisted of 200,000,000 shares of Common Stock and 46,868 shares of Series A Preferred Stock. As of the Record Date, there were 5,836,212 shares of Common Stock outstanding and 42,575 shares of Series A Preferred Stock outstanding. As set forth in the Texas Charter in the form attached to this Proxy Statement under Exhibit II, the proposed authorized capital of Alset consists of four hundred million (400,000,000) shares, of which two hundred million (200,000,000) shares shall be “blank check” preferred stock, par value $.02 per share (“Alset Preferred Stock”), and two hundred million (200,000,000) shares shall be Alset Common Stock. The number of shares of Alset Preferred Stock that will be designated as Alset Series A will be the number of Series A Convertible Stock outstanding on the date of filing of the Texas Charter.

The term “blank check” refers to preferred stock, the creation and issuance of which is authorized in advance by stockholders and the terms, rights and features of which are determined by the Board of Directors upon issuance. The authorization of such blank check preferred stock permits the board of directors to authorize and issue preferred stock from time to time in one or more series without seeking further action or vote of our stockholders.

The Board of Directors believes the authorization of the blank check preferred stock will give the Company the increased financial flexibility to respond deftly to potential acquisitions and opportunities, arrange financings at more favorable rates, and for other corporate purposes.

While we are asking stockholders to approve this proposal, we do not currently have any plan to issue any shares of preferred stock. The Reincorporation will not affect our total stockholder equity or total capitalization.

Regulatory Approvals and Third-Party Consents

Other than receipt of stockholder approval and the filing of a Texas Merger Certificate with the Texas Secretary of State and a New York Merger Certificate with the New York Secretary of State, to our knowledge, there are no federal or state regulatory requirements or approvals that must be obtained in order for us to consummate the Reincorporation. Although the Reincorporation will require a technical relisting of our Common Stock on the NYSE American following the Reincorporation, our Common Stock will continue to be traded on the NYSE American and is expected to trade under a new stock symbol to coincide with the Company’s rebranding. To the extent the Reincorporation will require the consent or waiver of a third party (for example, the consent of the Company’s primary lender), the Company will use commercially reasonable efforts to obtain such consent or waiver before completing the Reincorporation. If a material consent cannot be obtained, the Company may determine not to proceed with the Reincorporation.

Employee and Director Benefit Matters

All employee benefit plans of the Company will be continued by Alset. The Company’s other employee benefit arrangements will also be continued by Alset upon the terms and subject to the conditions in effect prior to the Reincorporation. The Reincorporation will not accelerate the time of payment or vesting, or increase the amount of compensation or benefits under, any of the Company’s agreements with its directors and employees or any of its compensation and benefit programs.

Effect of the Reincorporation on Stock Certificates

If this Reincorporation Proposal is approved, and the Company proceeds with the Reincorporation, it will not be necessary for stockholders to exchange their existing stock certificates for Alset stock certificates. However, as a result of the Reincorporation and Name Change, our Common Stock will receive a new CUSIP number, the number used to identify the Company’s equity securities. If at any time on or after the Effective Time a stockholder wishes to acquire a stock certificate with the new CUSIP number, the stockholder may do so by surrendering its, his or her certificate with the old CUSIP number to the transfer agent for Alset with a request for a replacement certificate. Following the Reincorporation, the transfer agent for Alset will continue to be American Stock Transfer and Trust Company

The Reincorporation will have no effect on the transferability of outstanding stock certificates representing the Company’s Common Stock.

Dissenters’ Rights of Appraisal

Pursuant to New York law, if the Reincorporation is approved by the Company’s stockholders, stockholders who dissent from the Reincorporation will not be entitled to appraisal rights.

Certain U.S. Federal Income Tax Consequences of the Reincorporation

The following is a brief summary of certain U.S. federal income tax consequences to holders of the Company’s Common Stock who receive Alset Common Stock as a result of the Reincorporation. The summary sets forth such consequences to the Company’s stockholders who hold their shares as a capital asset (generally, an asset held for investment).

This summary is for general information only and does not purport to be a complete discussion or analysis of all potential tax consequences that may apply to a stockholder. Stockholders are urged to consult their tax advisors to determine the particular tax consequences of the Reincorporation, including the applicability and effect of federal, state, local or foreign tax laws. This summary is based on the Internal Revenue Code of 1986, as amended (the “Code”), the Treasury Regulations promulgated thereunder, and rulings and decisions in effect as of the date of this Proxy Statement, all of which are subject to change, possibly with retroactive effect, and to differing interpretations.

The Company has neither requested nor received a tax opinion from legal counsel with respect to the U.S. federal income tax consequences of the Reincorporation. No rulings have been or will be requested from the Internal Revenue Service as to the federal income tax consequences of the Reincorporation.

The Reincorporation provided for in the Merger Agreement is intended to be treated as a “tax-free” reorganization as described in Section 368(a)(1)(F) of the Code. Assuming that the Reincorporation qualifies as a “tax-free” reorganization, no gain or loss will be recognized to the holders of the Company’s Common Stock as a result of the consummation of the Reincorporation, and no gain or loss will be recognized by the Company or Alset. The basis of the acquired assets in the hands of Alset will be the same as the Company’s basis in such assets. Each former holder of the Company’s Common Stock will have the same basis in Alset Common Stock received by that holder pursuant to the Reincorporation as was the basis in the Company Common Stock held at the time the reincorporation was consummated. Each stockholder’s holding period with respect to the Alset Common Stock will include the period during which that stockholder held the corresponding the Company’s Common Stock, provided the latter was held by such holder as a capital asset at the time the Reincorporation was consummated.

Comparison of Stockholder Rights Before and After the Reincorporation

Subject to stockholder approval prior to the Effective Time, the Company will change its state of incorporation to Texas and will thereafter be governed by TBOC, the Texas Charter and the Texas By-laws. There are certain differences between the rights of our stockholders under:

Set forth below is a table that summarizes some of the significant differences in the Texas Rights and the New York Rights. Unless otherwise specified in the table, the New York Governing Documents do not differ from the default provisions of the NYBCL and the Texas Governing Documents do not differ from the default provisions of the TBOC. The following summary does not purport to be a complete statement of the Texas Rights and the New York Rights, and is qualified in its entirety by reference to the full text of the New York Governing Documents, the Texas Governing Documents, the NYBCL and the TBOC.

|

| |||

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

| ||||

|

| |||

The approval of the reincorporation of the Company from New York to Texas requires the affirmative vote of a majority of the shares of the outstanding shares of the Company’s Common Stock entitled to vote on this Proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL 5.

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Directors and Executive Officers

The Company’s Board of Directors currently consists of eight directors; the Board size was increased from seven to eight persons on September 22, 2020, upon recommendation and approval by the Nominating and Corporate Governance Committee to do so.

Our executive officers and directors as of the date of this report are as follows:

| NAME | POSITION | |

| Frank D. Heuszel | Chief Executive Officer, Director | |

| Jason Grady | Chief Operating Officer | |

| Todd D. Macko | ||

| Heng Fai Ambrose Chan | Director, Executive Chairman | |

| John “JT” Thatch | Director | |

| José Escudero | Director | |

| Sassuan (Samson) Lee | ||

| Director | ||

| Wai Leung William Wu | Director | |

| Tung Moe Chan | Director |

Biographical and certain other information concerning the Company’s officers and directors is set forth below. Except for Mr. Heng Fai Ambrose Chan and his son Mr. Tung Moe Chan, there are no familial relationships among any of our directors. Except as indicated below, none of our directors is a director inof any other reporting companies. None of our directors has been affiliated with any company that has filed for bankruptcy within the last ten years. We are not aware of any proceedings to which any of our directors, or any associate of any such director is a party adverse to us or any of our subsidiaries or has a material interest adverse to us or any of our subsidiaries. Each executive officer serves at the pleasure of the Board of Directors.

| Name | Age | Director/Officer Since | Principal Occupation or Occupations and Directorships | |||

| Frank D. Heuszel | 64 | 2018 | Frank D. Heuszel has served as a director of the Company since July 30, 2018, and from July 2018 to April 2019, he served as chairman of the Company’s Audit Committee. Until October 28, 2020, he served as both the Company’s Chief Executive Officer and Interim Chief Financial Officer since April 17, 2019. Since then he serves only as the Chief Executive Officer and a director of the Company Mr. Heuszel has extensive expertise in a wide array of strategic, business, turnaround, and regulatory matters across several industries as a result of his executive management, educational, and operational experience. Prior to joining DSS, Mr. Heuszel had a very successful career in commercial banking. For over 35 years, Heuszel served in many senior executive roles with major US and international banking organizations. As a banker Mr. Heuszel has served as General Counsel, Director of Special Assets, Credit Officer, Chief Financial Officer and Auditor. Mr. Heuszel also operated a successful law practice focused on the litigation, corporate restructures, and merger and acquisitions, and collections. In addition to being an attorney and executive manager, Mr. Heuszel is also a Certified Public Accountant (retired), and a Certified Internal Auditor. Mr. Heuszel graduated from The University of Texas at Austin and from The South Texas College of Law, Houston.

On September 29, 2020, Mr. Heuszel was elected to the Board of Directors of the publicly traded company, Sharing Services Global Corporation, which is an OTCQB public company. At the time of the appointment, DSS owned 32.2% of the outstanding shares of Sharing Services, a diversified company dedicated to maximizing shareholder value through the acquisition and development of innovative companies, products, and technologies in the direct selling industry. |

| Jason Grady | 45 | 2018 | Jason Grady has served as Chief Operating Officer of the Company since August of 2019 and, from July 2018, Mr. Grady has also served as President of Premier Packaging Corporation, a multi-division folding carton and security packaging company and wholly-owned subsidiary of the Company. From April 2010 through July 2018, Mr. Grady served as the Company’s Vice President of Sales. As COO, Mr. Grady’s role includes the operational management of multiple divisions, advising the direction of each of the company’s newly-formed subsidiaries, and the research and development of emerging market opportunities across diverse business operations. Mr. Grady’s roles have included strategic leadership and driving key initiatives that include re-engineering sales organizations, new business development, international sales, sales management and corporate marketing. He was responsible for the overall management of multi-divisional sales including anti-counterfeit & authentication solutions, enterprise security software technologies, and document security printing. Prior to his success at DSS, Mr. Grady served as Vice President of Marketing for the Parlec Corporation, a multi-market machine tool manufacturer, as the Director of Business Development for Berlin Packaging Corporation, a custom ridged box and folding carton manufacturer, and as a sales and marketing executive for OutStart, Inc. an enterprise e-learning software company. Mr. Grady obtained an undergraduate degree in Marketing and Communications and a Masters Degree in Business Administration from the Rochester Institute of Technology. | |||

| Todd D. Macko | 48 | 2020 | Todd Macko was promoted to Interim Chief Financial Officer effective October 28, 2020. Mr. Macko previously served as the Vice President of Finance of the Company. As the Vice President of Finance, Mr. Macko’s responsibilities included assisting DSS’s Interim Chief Financial Officer in all aspects of financial and regulatory reporting. In addition, his responsibilities included the day-to-day management of the Company’s Accounting and Finance team and the financial leadership in the directing and improving of the accounting, reporting, audit, and tax activities. Prior to his role as Vice President of Finance for the Company, Mr. Macko joined the wholly owned subsidiary of DSS, Premier Packaging Corporation in January 2019, as its Vice President of Finance.

Mr. Macko is a Certified Public Accountant with over 25 years of public and corporate financial management, business leadership and corporate strategy. Mr. Macko brings a wealth of experience with strengths in financial planning and analysis, business process re-engineering, budgeting, merger and acquisitions, financial reporting systems, project evaluation and treasury and capital management.

Prior to joining the Company, Mr. Macko served as the Corporate Controller for Baldwin Richardson Foods, a leading custom ingredients manufacturer for the food and beverage industry from November 2015 until January 2019. Prior to that, Mr. Macko served as the Controller for The Outdoor Group, LLC., Genesis Vision, Inc., Complemar Partners, Inc., and Level 3 Communications, Inc. Mr. Macko obtained is Bachelor of Science in Accounting from Rochester Institute of Technology. | |||

| Heng Fai Ambrose Chan | 75 | 2017 | Heng Fai Ambrose Chan has served as a director of the Company since February 12, 2017 and became Chairman of the Board of Directors on March 27, 2019. He has also served as an officer of the Company’s wholly-owned subsidiary, DSS International Inc., since July of 2017. Mr. Chan is an expert in banking and finance, with years of experience in the industry. Mr. Chan has restructured 35 companies in various industries and countries in the past 40 years. Mr. Chan currently serves as the Chief Executive Officer of Alset International, Inc. (formerly known as Singapore eDevelopment Limited (SED)), a publicly traded company on the Singapore Stock Exchange. He also serves as a director of BMI Capital Partners International Ltd., a wholly-owned subsidiary of SED. Mr. Chan also serves on the board of Holista CollTech Limited, a publicly traded company listed on the Australian Securities Exchange and Sharing Services Global Corporation, which is an OTCQB public company

Mr. Chan formerly served as (i) Managing Chairman of Heng Fai Enterprises Limited (now known as ZH International Holdings Limited) which trades on the Hong Kong Stock Exchange; (ii) the Managing Director of SGX Catalist-listed SingHaiyi Group Ltd., which under his leadership, transformed from a failing store-fixed business provider with net asset value of less than $10 million into a property trading and investment company and finally to a property development company with net asset value over $150 million before Mr. Chan ceded controlling interest in late 2012; (iii) the Executive Chairman of China Gas Holdings Limited, a formerly failing fashion retail company listed on the Hong Kong Stock Exchange, which under his direction, was restructured to become one of the few large participants in the investment in and operation of city gas pipeline infrastructure in China; (iv) a director of Global Med Technologies, Inc., a medical company listed on NASDAQ engaged in the design, development, marketing and support information for management software products for healthcare-related facilities; (v) a director of Skywest Limited, an ASX-listed airline company; and (vi) the Chairman and Director of American Pacific Bank. In 1987, Mr. Chan acquired American Pacific Bank, a full-service U.S. commercial bank, and brought it out of bankruptcy. He recapitalized, refocused and grew the bank’s operations. Under his guidance it became a NASDAQ-listed high asset quality bank with zero loan losses for over five consecutive years before it was ultimately bought and merged into Riverview Bancorp Inc. Mr. Chan’s international business contacts and experience qualifies him to serve on our Board of Directors. |

| 6 |

| Name | Age | Director/Officer Since | Principal Occupation or Occupations and Directorships | |||

| Frank D. Heuszel | 65 | 2018 | Mr. Frank D. Heuszel has served as a director of the Company since July 30, 2018, and from July 2018 to April 2019, he served as chairman of the Company’s Audit Committee. From April 17, 2019 until October 28, 2020, he served as both the Company’s Chief Executive Officer and Interim Chief Financial Officer. Since then, he serves only as the Chief Executive Officer and a director of the Company Mr. Heuszel has extensive expertise in a wide array of strategic, business, turnaround, and regulatory matters across several industries as a result of his executive management, educational, and operational experience. Prior to joining DSS, Mr. Heuszel had a very successful career in commercial banking. For over 35 years, Mr. Heuszel served in many senior executive roles with major US and international banking organizations. As a banker Mr. Heuszel has served as General Counsel, Director of Special Assets, Credit Officer, Chief Financial Officer and Auditor. Mr. Heuszel also operated a successful law practice focused on litigation, corporate restructures, and mergers and acquisitions, and collections. In addition to being an attorney and executive manager, Mr. Heuszel is also a Certified Public Accountant (retired), and a Certified Internal Auditor (retired). Mr. Heuszel graduated from The University of Texas at Austin and from The South Texas College of Law, Houston.

On September 29, 2020, Mr. Heuszel was elected to the Board of Directors of the publicly traded company, Sharing Services Global Corporation (“Sharing Services”), which is an OTCQB public company. He continues to serve on the Sharing Services board. DSS currently owns approximately 46.7% of the outstanding shares of Sharing Services, a diversified company dedicated to maximizing shareholder value through the acquisition and development of innovative companies, products, and technologies in the direct selling industry. |

| Jason Grady | 47 | 2018 | Mr. Jason Grady has served as Chief Operating Officer of the Company since August of 2019 and, since July 2018, Mr. Grady has also served as President of Premier Packaging Corporation, a multi-division folding carton and security packaging company and wholly-owned subsidiary of the Company. From April 2010 through July 2018, Mr. Grady served as the Company’s Vice President of Sales. As COO, Mr. Grady’s role includes the operational management of multiple divisions, advising the direction of each of the company’s newly-formed subsidiaries, and the research and development of emerging market opportunities across diverse business operations. Mr. Grady’s roles have included strategic leadership and driving key initiatives that include re-engineering sales organizations, new business development, international sales, sales management and corporate marketing. He was responsible for the overall management of multi-divisional sales including anti-counterfeit & authentication solutions, enterprise security software technologies, and document security printing. Prior to his success at DSS, Mr. Grady served as Vice President of Marketing for the Parlec Corporation, a multi-market machine tool manufacturer; as the Director of Business Development for Berlin Packaging Corporation, a custom ridged box and folding carton manufacturer; and as a sales and marketing executive for OutStart, Inc., an enterprise e-learning software company. Mr. Grady obtained an undergraduate degree in Marketing and Communications and a Master’s Degree in Business Administration from the Rochester Institute of Technology. |

| 7 |

| Todd D. Macko | 49 | 2020 | Mr. Todd Macko was promoted to Interim Chief Financial Officer effective October 28, 2020 and was appointed Chief Financial Officer on August 16, 2021. Mr. Macko previously served as the Vice President of Finance of the Company. As the Vice President of Finance, Mr. Macko’s responsibilities included assisting DSS’s Interim Chief Financial Officer in all aspects of financial and regulatory reporting. In addition, his responsibilities included the day-to-day management of the Company’s Accounting and Finance team and financial leadership in the directing and improving of accounting, reporting, audit, and tax activities. Prior to his role as Vice President of Finance for the Company, Mr. Macko joined the wholly owned subsidiary of DSS, Premier Packaging Corporation in January 2019, as its Vice President of Finance.

Mr. Macko is a Certified Public Accountant with over 25 years of public and corporate financial management, business leadership and corporate strategy. Mr. Macko brings a wealth of experience with strengths in financial planning and analysis, business process re-engineering, budgeting, merger and acquisitions, financial reporting systems, project evaluation and treasury and capital management.

Prior to joining the Company, Mr. Macko served as the Corporate Controller for Baldwin Richardson Foods, a leading custom ingredients manufacturer for the food and beverage industry from November 2015 until January 2019. Prior to that, Mr. Macko served as the Controller for The Outdoor Group, LLC., Genesis Vision, Inc., Complemar Partners, Inc., and Level 3 Communications, Inc. Mr. Macko obtained his Bachelor of Science in Accounting from Rochester Institute of Technology. | |||

| Heng Fai Ambrose Chan | 76 | 2017 | Mr. Heng Fai Ambrose Chan has served as a director of the Company since February 12, 2017 and became Chairman of the Board of Directors on March 27, 2019. He has also served as an officer of the Company’s wholly-owned subsidiary, DSS International Inc., since July of 2017. Mr. Chan is an expert in banking and finance, with years of experience in the industry. Mr. Chan has restructured 35 companies in various industries and countries over the past 40 years. Mr. Chan currently serves as the Chairman and Chief Executive Officer of Alset International Ltd. (formerly known as Singapore eDevelopment Limited (SED))(“Alset International”), a publicly traded company on the Singapore Stock Exchange. He also serves as a director of BMI Capital Partners International Ltd., a wholly-owned subsidiary of Alset International. Mr. Chan also serves on the board of Sharing Services Global Corporation, which is an OTCQB public company. Mr. Chan has served as a member of the Board of Directors of LiquidValue Development Inc. since January 10, 2017, and has served as Co-Chief Executive Officer of LiquidValue Development Inc. since December 29, 2017. Mr. Chan has also served as a non-executive director of Holista CollTech Ltd., a publicly traded company on the Australian Securities Exchange, since July 2013 Mr. Chan has served as a director of OptimumBank Holdings, Inc., a publicly traded company on the Nasdaq Capital Markets and Optimum Bank since June 2018.

Mr. Chan formerly served as (i) Managing Chairman of Heng Fai Enterprises Limited (now known as ZH International Holdings Limited) which trades on the Hong Kong Stock Exchange; (ii) the Managing Director of SGX Catalist-listed SingHaiyi Group Ltd., which under his leadership, transformed from a failing store-fixed business provider with net asset value of less than $10 million into a property trading and investment company and finally to a property development company with net asset value over $150 million before Mr. Chan ceded his controlling interest in late 2012; (iii) the Executive Chairman of China Gas Holdings Limited, a formerly failing fashion retail company listed on the Hong Kong Stock Exchange, which under his direction, was restructured to become one of the few large participants in the investment in and operation of city gas pipeline infrastructure in China; (iv) a director of Global Med Technologies, Inc., a medical company listed on NASDAQ engaged in the design, development, marketing and support information for management software products for healthcare-related facilities; (v) a director of Skywest Limited, an ASX-listed airline company; and (vi) the Chairman and Director of American Pacific Bank. In 1987, Mr. Chan acquired American Pacific Bank, a full-service U.S. commercial bank, and brought it out of bankruptcy. He recapitalized, refocused and grew the bank’s operations. Under his guidance it became a NASDAQ-listed high asset quality bank with zero loan losses for over five consecutive years before it was ultimately bought and merged into Riverview Bancorp Inc. Mr. Chan’s international business contacts and experience qualify him to serve on our Board of Directors. |

| 8 |

| John “JT” Thatch | 2019 | Mr. John “JT” Thatch has served as a director of the Company since May 9, 2019 and as Lead Independent Director since December 9, 2019. Mr. Thatch is an accomplished professional and entrepreneur who has started, owned and operated several businesses in various industries and in both the public and private arena. The industries in which his companies have operated include the service, retail, wholesale, education, finance, real estate management and technology industries. Since March 2018, Mr. Thatch has served as the Chief Executive Officer and a director of Sharing Services Global Corporation, a publicly traded holding company focused in the direct selling and marketing industry. He is also a principal owner of Superior Wine & Spirits, a Florida-based company that imports, wholesales and distributes wine and liquor throughout the State of Florida. He has been involved in this business venture since February of 2016. From January 2009 until January 2016, Mr. Thatch served as Chief Executive Officer of Universal Education Strategies, |

| José Escudero | 46 | 2019 | Mr. José Escudero has served as a director of the Company since August 5, 2019. He has served as the Managing Partner at BMI Capital Spain, a private investment bank, since September 2013. Previously, Mr. Escudero served as Principal at Hallman & Burke, an international consulting firm, from July 2009 through September 2013. Mr. Escudero has a B.Sc. in Economics from the Francisco de Vitoria University and a Master’s degree in Corporate Finance and Investment Banking from the Options & Futures Institute. Mr. Escudero’s experience in mergers and acquisitions, corporate finance, and international trade along with his education in economics and finance and investment banking qualify him to serve on the Company’s Board of Directors and as a member of the |

| José Escudero | 44 | 2019 | José Escudero has served as a director of the Company since August 5, 2019. He has served as the Managing Partner at BMI Capital Spain, a private investment bank, since September 2013. Previously, Mr. Escudero served as Principal at Hallman & Burke, an international consulting firm, from July 2009 through September 2013. Mr. Escudero has a B.Sc. in Economics from the Francisco de Vitoria University and a Master’s degree in Corporate Finance and Investment Banking from the Options & Futures Institute. Mr. Escudero’s experience in merger and acquisitions, corporate finance, and international trade along with his education in economics and finance and investment banking qualifies him to serve on the Company’s Board of Directors | |||

Sassuan (Samson) Lee | 49 | 2019 | Mr. Sassuan (Samson) Lee has served as a director of the Company since August 5, 2019. He co-founded STO Global X, a technology and service provider for security token exchange solutions, in December 2017. He has also served as the Chief Crypto-Economic Advisor for Gibraltar Stock Exchange and Gibraltar Blockchain Exchange since September 2017. In November 2016, Mr. Lee founded Coinstreet Partners, a consultancy firm focused on blockchain, fintech, cryptocurrency and digital assets, and has served as its Chief Executive Officer since inception. Mr. Lee currently serves on the board of directors of Sharing Services Global Corporation, which is an OTCQB public company. Mr. Lee previously served as Managing Director at uCast Global Asia from December 2015 through November 2016. Mr. Lee also served as the Executive Vice President of the Greater China region at Movideo from June 2015 through December 2015 and as Vice President and General Manager of the Greater China and South Asia Pacific regions at NeuLion Inc. from July 2008 through June 2015. Mr. Lee received his Bachelor of Commerce degree from the University of Toronto and his MBA and MS degrees from the Hong Kong University of Science and Technology. Mr. Lee’s extensive experience and recognized expert in the fields of technology, blockchain, cryptocurrency and fintech, combined with his experience as Chief Executive Officer and Managing Director of successful international businesses qualifies him to serve on the Company’s Board of Directors and a member of the DSS Audit Committee | |||

| Wai Leung William Wu | 53 | 2019 | Mr. Wai Leung William Wu has served as a director of the Company since October 20, 2019. He served as the managing director of Investment Banking at Glory Sun Securities Limited since January 2019. Mr. Wu previously served as the executive director and chief executive officer of Power Financial Group Limited from November 2017 to January 2019. Mr. Wu has served as a director of Asia Allied Infrastructure Holdings Limited since February 2015. Mr. Wu previously served as a director and chief executive officer of RHB Hong Kong Limited from April 2011 to October 2017. Mr. Wu served as the chief executive officer of SW Kingsway Capital Holdings Limited (now known as Sunwah Kingsway Capital Holdings Limited) from April 2006 to September 2010. Mr. Wu holds a Bachelor of Business Administration degree and a Master of Business Administration degree of Simon Fraser University in Canada. He was qualified as a chartered financial analyst of The Institute of Chartered Financial Analysts in 1996.

Mr. Wu previously worked for a number of international investment banks and possesses over 26 years of experience in the investment banking, capital markets, institutional broking and direct investment businesses. He is a registered license holder to carry out Type 6 (advising on corporate finance) and Type 9 (asset management) regulated activities under the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong). Mr. Wu has served as a member of the Guangxi Zhuang Autonomous Region Committee of the Chinese People’s Political Consultative Conference in January 2013. Mr. Wu’s experience in banking, capital markets, investment banking, Asian economic and banking dynamics, and education in corporate finance and asset management qualifies him to serve on the Company’s Board of Directors and a member of the DSS Audit Committee. |

| Wah Wai Lowell Lo | 56 | 2019 | Mr. Wah Wai Lowell Lo (also known as Lowell Lo) has served as a director of the Company since April 12, 2019. Mr. Lo is currently Chairman and Managing Director of the BMI Intelligence Group Limited, a leading corporate consulting and financial services firm in the Asia Pacific Region he founded in 1995, and is responsible for the overall management, strategic planning and development of the firm. Prior to establishing BMI Intelligence Group Limited, Mr. Lo was the Audit Manager of Deloitte Touche Tohmatsu for nine years, including two years of service in Deloitte’s U.S. headquarters. Mr. Lo has extensive experience with initial public offerings and has participated in the listings of several companies including Ajisen Remen, 361 Degrees Group, Lilanz Group and IGG. Mr. Lo’s professional qualifications include Hong Kong Certified Public Accountants (CPA), American Institute of Certified Public Accountants (AICPA), Information Systems Auditor and Control Association (ISACA) and Senior International Finance Manager (SIFM). Mr. Lo is also currently and independent, non-executive board member of Chongqing Machinery & Electric Co., Ltd. And Tenfu (Cayman) Holdings Company Limited, both Hong Kong Exchange-listed companies. Mr. Lo received his bachelor’s degree in Business Administration from the Chinese University of Hong Kong and a master’s degree from the New Jersey Institute of Technology. Mr. Lo’s financial expertise and experience in the management and strategic development of various companies qualifies him to serve on the Company’s board of directors. | |||

| Tung Moe Chan | 42 | 2020 | Mr. Tung Moe Chan has served as a director of the Company since September 2020. He currently serves as Group Chief Development Officer of Singapore Exchange-listed Alset International Limited, overseeing the company’s global property business, and as Vice President and Director of Corporate Development of American Medical REIT Inc., positions he has held since August 2020. Mr. Moe Chan also serves as Co-Chief Executive Officer and Director of LiquidValue Development Inc. (f.k.a SeD Intelligent Home Inc.)(USA), a company he joined in 2017, and as Director and Chief Executive Officer (International) of Alset IHome Inc. (f.k.a. SeD Home & REITs Inc.)(USA) a company he joined in 2015. He previously served as Chief Executive Officer of Pop Motion Consulting Pte Ltd. (Singapore) from 2018 to 2020. Prior to that, in 2015 he was Group Chief Operating Officer of Hong Kong Stock Exchange listed Zensun International Limited where he was responsible for the company’s global business operations consisting of REIT ownership and management, property development, hotels and hospitality, as well as property and securities investment and trading. Within the past five years, Mr. Moe Chan has served as a director of MasterCard issuer Xpress Finance Limited as well as RSI International Systems Inc., which was a hotel software company listed on the Toronto Stock Exchange.

He holds a Master’s Degree in Business Administration with honors from the University of Western Ontario, a Master’s Degree in Electro-Mechanical Engineering with honors and a Bachelor’s Degree in Applied Science with honors from the University of British Columbia. |

| 9 |

| Sassuan (Samson) Lee | 50 | 2019 | Mr. Sassuan (Samson) Lee has served as a director of the Company since August 5, 2019. He co-founded STO Global X, a technology and service provider for security token exchange solutions, in December 2017. He has also served as the Chief Crypto-Economic Advisor for Gibraltar Stock Exchange and Gibraltar Blockchain Exchange since September 2017. In November 2016, Mr. Lee founded Coinstreet Partners, a consultancy firm focused on blockchain, fintech, cryptocurrency and digital assets, and has served as its Chief Executive Officer since inception. Mr. Lee currently serves on the board of directors of Sharing Services Global Corporation, which is an OTCQB public company. Mr. Lee previously served as Managing Director at uCast Global Asia from December 2015 through November 2016. Mr. Lee also served as the Executive Vice President of the Greater China region at Movideo from June 2015 through December 2015 and as Vice President and General Manager of the Greater China and South Asia Pacific regions at NeuLion Inc. from July 2008 through June 2015. Mr. Lee received his Bachelor of Commerce degree from the University of Toronto and his MBA and MS degrees from the Hong Kong University of Science and Technology. Mr. Lee’s extensive experience and recognized expertise in the fields of technology, blockchain, cryptocurrency and fintech, combined with his experience as Chief Executive Officer and Managing Director of successful international businesses qualifies him to serve on the Company’s Board of Directors and as a member of the Audit Committee and the Nominating and Corporate Governance Committee and the Chairman of the Compensation and Management Resources Committee. | |||

| Wai Leung William Wu | 55 | 2019 | Mr. Wai Leung William Wu has served as a director of the Company since October 20, 2019. He served as the managing director of Investment Banking at Glory Sun Securities Limited since January 2019. Mr. Wu previously served as the executive director and chief executive officer of Power Financial Group Limited from November 2017 to January 2019. Mr. Wu has served as a director of Asia Allied Infrastructure Holdings Limited since February 2015. Mr. Wu previously served as a director and chief executive officer of RHB Hong Kong Limited from April 2011 to October 2017. Mr. Wu served as the chief executive officer of SW Kingsway Capital Holdings Limited (now known as Sunwah Kingsway Capital Holdings Limited) from April 2006 to September 2010. Mr. Wu holds a Bachelor of Business Administration degree and a Master of Business Administration degree of Simon Fraser University in Canada. He was qualified as a chartered financial analyst of The Institute of Chartered Financial Analysts in 1996.